Charting the Global Economic Landscape: China’s Stimulus Strategy

China’s recent economic maneuvers have sent waves across global markets, igniting discussions among economists and analysts alike. The nation’s commitment to stimulating its economy to combat deflation reflects a proactive approach. This week, we observed the People’s Bank of China (PBOC) implement significant measures, including substantial cuts to interest rates on one-year loans and alterations to regulations regarding second home purchasing.

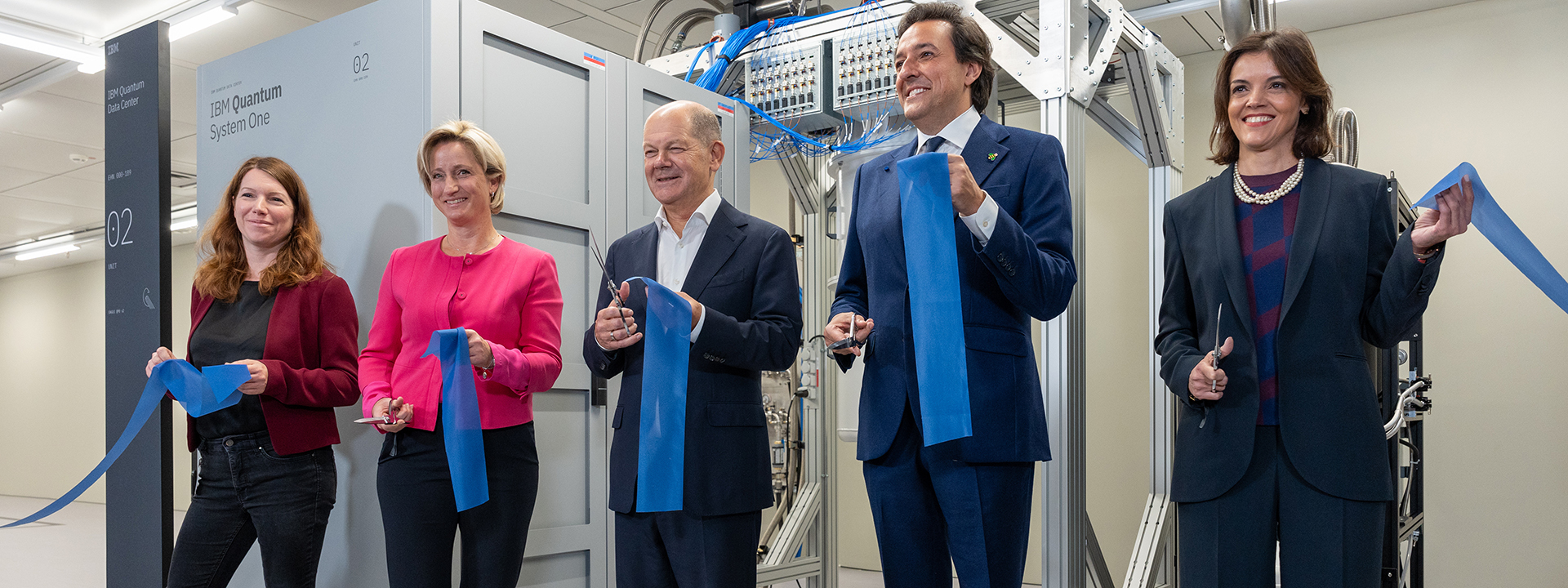

China implements measures to boost its economy.

The sweeping strategies, which aim to revive consumer confidence, are a striking reminder of the delicate interplay between global economies. A recent interest rate cut to just 2% for medium-term lending, marking the most considerable reduction since the introduction of this monetary tool, signals a pivotal shift. This decision is not merely about numbers; it represents a broader effort to reignite growth within a sluggish economic framework that is grappling with issues such as a volatile property market and low consumer prices.

Economists alert us that these measures may be merely a band-aid over deeper issues. The complexity of China’s economic structure, valued at around $18 trillion, is fraught with significant challenges. The sharp drop in property prices following regulatory tightening in previous years has left many families hesitant and uncertain. As the government rolls out cash incentives and additional subsidies for students entering the job market, we’re witnessing a crucial attempt to tackle not just economic symptoms but the root of the malaise.

The Market’s Response

The immediate buoyancy in the markets following these announcements is a testament to the drastic need for revitalizing economic confidence. Just a few days ago, traders reacted positively, sending shares soaring. This rise may not hold in the long term, as analysts caution that sustainable recovery needs a sound and systemic rethink rather than a series of short-term fixes.

Market reactions reflect initial optimism.

Market reactions reflect initial optimism.

Histories of major economic shifts often serve as valuable lessons. Take, for instance, the 2008 financial crisis when reactive measures were employed. While they stabilized economies temporarily, the aftermath revealed that without foundational reform, markets can be precarious. Thus, as we analyze China’s present situation, it invites us to ponder: will this strategy cultivate long-lasting stability, or is it merely postponing the inevitable?

Global Implications

China’s economic choices hold substantial weight on the global stage. An economy that consistently grows fosters trade connections with multiple nations, directly impacting jobs and investments worldwide. Conversely, if the Chinese economy falters, ripples can be felt from Tokyo to New York. The lifting of restrictions on second home purchases may echo through international real estate markets, particularly as affluent buyers seek opportunities.

This situation parallels shifts seen in other economies, such as the United States, where inflation control measures have become increasingly prominent. Much like China’s strategy now, the Federal Reserve has adopted a cautious yet proactive approach regarding interest rate changes. For consumers and investors, these trends signal deeper signals about both nations’ economic climates and their potential long-term viability.

Conclusion: A Testing Ground for Economic Theory

As we continue to observe China’s approach, the importance of this economic experiment cannot be overstated. It serves as a testing ground for economic theories previously deemed effective. For instance, the relationship between interest rates and consumer spending is at the forefront of discussions among economists. Will lowering rates revive demand? Can increased fiscal spending stabilize the property market? These questions linger as we delve into future implications.

Predictions about the future remain uncertain.

Predictions about the future remain uncertain.

The stakes are high, and the world will be watching closely. In the coming months, I urge us all to keep our eyes peeled for shifts in policy and their resulting effects on both the Asian and global economies. As China attempts to steer its economic ship towards calmer waters, how they navigate the storm ahead will significantly influence the economic landscapes beyond their borders.

To stay updated on these developments, keep an eye on financial news sources and analysis platforms that provide real-time insights into the evolving situation.

Further Reading

Stay tuned for additional insights as the story develops.