Transforming Banking: The Role of Generative AI in Cloud Migration and Python’s Evolution

As the banking industry grapples with the complexities of legacy systems and the need for digital transformation, generative artificial intelligence (GenAI) is emerging as a vital tool to expedite processes and enhance operational efficiency. Simultaneously, the programming landscape is evolving with the release of Python 3.13, which includes significant enhancements aimed at improving developer experience.

Generative AI: A Catalyst for Change in Banking

For decades, banks have faced relentless challenges associated with outdated technology stacks. As customer expectations evolve and the demand for nimble digital services grows, many financial institutions are looking towards GenAI tools for support. Recently, four global banks entered discussions with tech provider EXL to leverage GenAI for streamlining their migration to cloud infrastructures. This initiative is not merely about maintaining pace but reimagining how banks can use technology to resolve compliance dilemmas while optimizing data management processes.

Generative AI is reshaping the financial landscape by reducing reliance on human labor for tasks that are either too tedious or require the pinpoint precision of data management. By automating these processes, banks can not only save costs but also mitigate risks associated with human error.

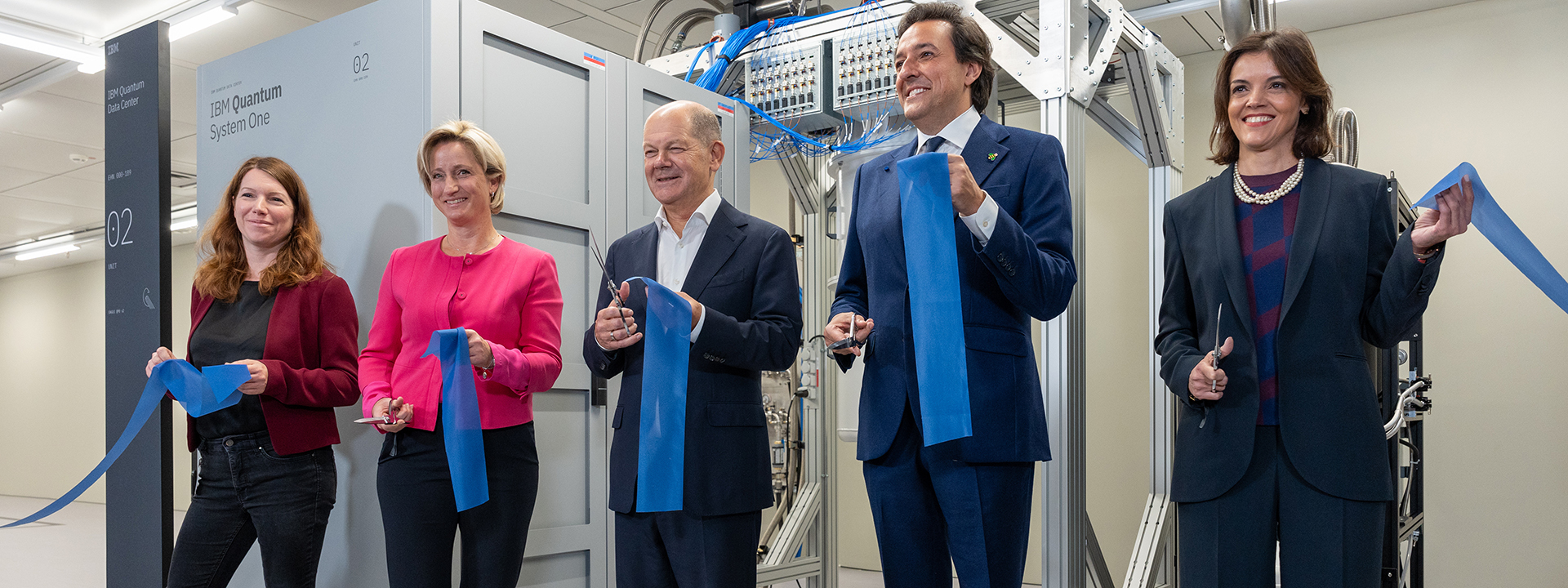

Exploring the intersection of generative AI and financial services.

Python 3.13: Innovations in Programming

As banks prepare for a digital future, programmers will play a crucial role in creating resilient infrastructures capable of supporting new technologies. One significant advancement in this area is the recent release of Python 3.13. This version introduces a completely overhauled interactive interpreter that dramatically enhances user experience. With features like multi-line editing, editing complex structures such as classes and functions becomes a seamless task.

The enhanced interpreter also simplifies access to help functions, allowing users to quickly reference documentation—a feature that will significantly benefit novices navigating the Python programming environment.

The Shift Towards Free-threaded Applications

Another groundbreaking feature is the experimental ability to disable the Global Interpreter Lock (GIL). This change enables applications to maximize CPU core utilization, allowing for improved multi-threading capabilities. As the demand for performance escalates, particularly in fields like data science and artificial intelligence, the elimination of GIL becomes a pivotal move for Python developers, unlocking potential that is long overdue.

The introduction of this free-threaded mode demonstrates an acute awareness of the limitations imposed by single-threaded models, especially in concurrent programming scenarios where Python has been historically critiqued. By addressing these constraints, Python positions itself more competitively against languages like Java, Go, and Rust, which integrate robust multi-threading paradigms.

The evolution of programming languages towards modern needs.

Embracing the Future with JIT

Alongside the free-threading capabilities, Python 3.13 also introduces an experimental Just-in-Time (JIT) compiler aimed at boosting performance. Though switched off by default, this compiler can be enabled during the build process, nudging Python closer to the efficiency that is often seen in compiled languages. The JIT capabilities are a leap forward from previous enhancements, such as the Specializing Adaptive Interpreter introduced in Python 3.11, as they promise considerable performance improvements for various applications.

A Synergistic Path Forward

The intersection of generative AI and advanced programming features holds immense potential for transforming how banks operate and how developers engage with technology. Global banks are starting to realize the value of accessing cutting-edge tools and embracing a shift towards the cloud. As generative AI tools facilitate the migration journey, the advancements in Python provide developers with the means to build on this new digital foundation.

In summary, the financial sector’s exploration of generative AI, coupled with the innovative features of Python 3.13, represents a crucial moment of adaptation and growth. Financial institutions that harness these tools will not only survive but thrive in an increasingly complex digital ecosystem.

Conclusion

As we look forward, the collaboration between technology and finance serves as a beacon of innovation. Generative AI is redefining operational methodologies within banks, while Python continues to evolve as a programming language that meets the demands of contemporary development. Together, these advancements promise to reshape the financial landscape, all while enhancing the capabilities and experiences of both developers and end-users.

The road ahead is exciting. As the banking industry accelerates its digital transformation, embracing new technologies like generative AI and adapting to programming innovations will be critical for staying relevant and competitive in the global market.

Imagining the future of banking in a digital world.

Article Summary

The article explores how global banks are leveraging generative AI tools to transform their migration to the cloud, while also discussing the latest features introduced in Python 3.13 which enhance the programming landscape. The combined advancements herald a new era for financial services and developers alike.