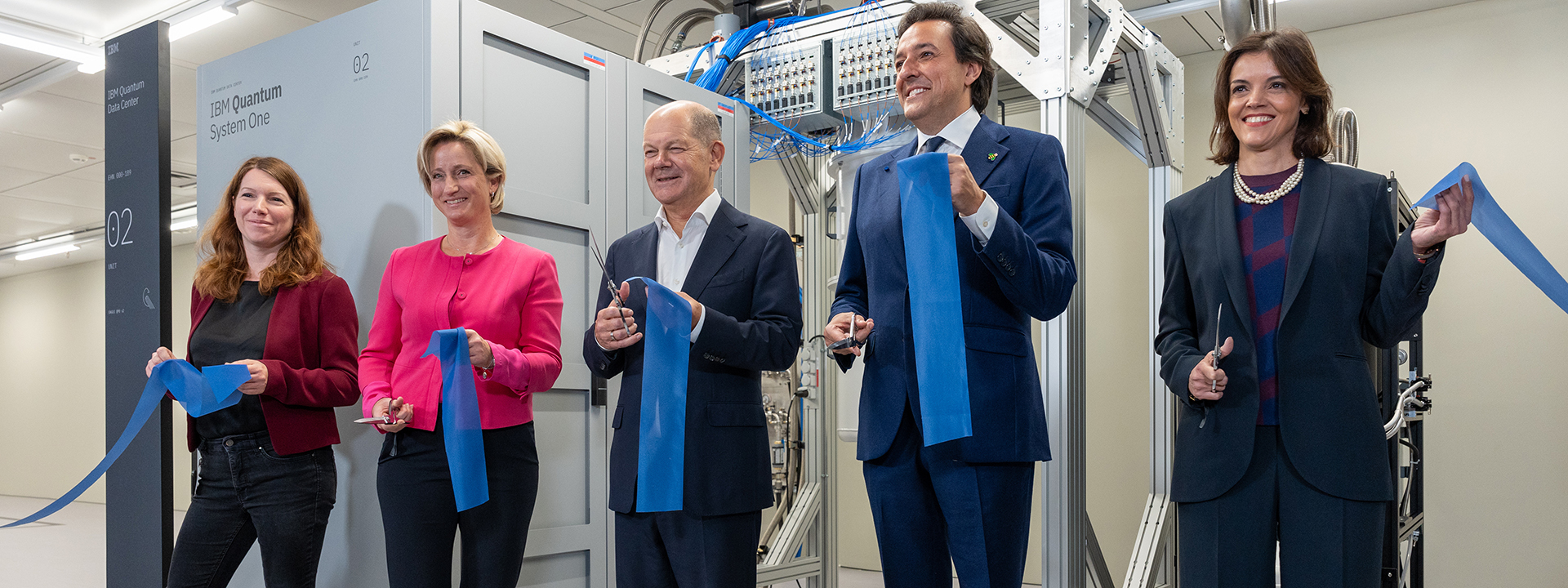

Embracing AI: How Global Banks are Transforming Cloud Migration

In an era where technology is evolving at lightning speed, the financial sector is not lagging behind. Global banks are increasingly turning to generative artificial intelligence (GenAI) tools to solve complex, legacy issues that have long haunted their operations. As someone who has often pondered the intricate dance of innovation and regulation within financial institutions, it’s fascinating to witness this strategic pivot towards AI, particularly in the context of cloud migration.

The intersection of AI and banking is reshaping the future.

The intersection of AI and banking is reshaping the future.

Tackling Legacy Challenges with GenAI

Banks have been grappling with legacy technology for decades. These outdated systems often hinder agility and innovation, creating a significant roadblock as they strive to meet modern customer expectations. The shift towards cloud computing presents an opportunity to not only upgrade their infrastructure but to fundamentally rethink how they operate. According to Kshitij Jain, a leading strategist from tech provider EXL, the integration of GenAI tools can streamline processes that previously seemed intractable or too costly for human intervention.

Imagine a scenario where massive data sets can be analyzed and migrated effortlessly to the cloud, saving time and reducing operational costs. This is not just a dream—it’s quickly becoming a reality for banks interested in harnessing AI capabilities. The allure of reducing labor costs while simultaneously increasing efficiency is undoubtedly attractive in today’s competitive financial landscape.

The Cloud Computing Conundrum

The migration to cloud services has been a multifaceted challenge for banks. On one hand, the benefits of scalability, improved security, and access to advanced analytics are undeniable. On the other, legacy systems that have been in place for years make the transition complex. It’s like trying to change the engine of a car while it’s still in motion.

Through the lens of my own experience with transformation initiatives, I can’t help but draw parallels with traditional industries that have faced similar hurdles. Many have found that having the right tools and approach—combined with a willingness to adapt—can lead to significant breakthroughs. For banks, deploying GenAI may be the key to bridging the gap between outdated technology and future-ready infrastructure.

The way forward for banks involves smart technology.

The way forward for banks involves smart technology.

A Change of Mindset

The embrace of GenAI also requires a cultural shift within these organizations. Employees accustomed to age-old practices may be hesitant to adopt new methodologies that AI introduces. However, those who champion these transformations will likely see an advantage in the long term. Just as industries like manufacturing have inflected toward automation, banks must also recognize the value in integrating AI to enhance productivity and innovation.

“Embracing technology not only facilitates efficiency but also addresses compliance challenges that have plagued the industry for years.”

This quote encapsulates the dual nature of GenAI’s potential—while one of its primary functions is to streamline operations, its impact on compliance cannot be overlooked. Regulatory requirements in banking are changing, and GenAI tools can help ensure adherence to these regulations more effectively than ever before.

The Road Ahead

As global banks race to adopt GenAI tools, it will be interesting to observe not only the technological advancements that unfold but also the cultural evolution within these institutions. A commitment to upskilling workforce members and promoting a mindset of adaptability will be crucial for sustained success.

Working in fintech, I’ve witnessed how traditional banks are beginning to mimic agile start-ups, adopting a more flexible approach to operations. This is a promising trend, signaling to me that the banks are not just preparing to survive in this tech-centric era but also striving to thrive.

Future of banking: an undeniable blend of AI and cloud.

Future of banking: an undeniable blend of AI and cloud.

In conclusion, the journey toward effective cloud migration using GenAI is one filled with potential. With the right tools, strong leadership, and a shift in culture, banks can address their legacy challenges and emerge more robust than ever. This transformation isn’t just about technology; it’s about reimagining the very essence of banking for a future that is just around the corner.

Final Thoughts

As we stand on the precipice of this massive shift, I remain optimistic. The integration of GenAI in banking may very well catalyze an era of unprecedented speed, efficiency, and innovation within financial services. In my view, the era of waiting for change is over; it’s now time to actively embrace it.