Why I’m Hooked on Dividend APIs: Unlocking the Power of Dividend History and Yields

As a seasoned investor, I’ve always been fascinated by the world of dividend investing. There’s something alluring about earning passive income from your investments, and dividend APIs have become an essential tool in my arsenal. In this article, I’ll share my top picks for the best dividend APIs on the market, and why I think they’re a game-changer for investors.

The Importance of Dividend History

When it comes to dividend investing, understanding a company’s dividend history is crucial. It’s not just about the yield; it’s about the consistency and reliability of those dividend payments. That’s where dividend APIs come in – they provide a treasure trove of data on dividend history, yields, and payout ratios. With this information, investors can make informed decisions about their investments and avoid costly mistakes.

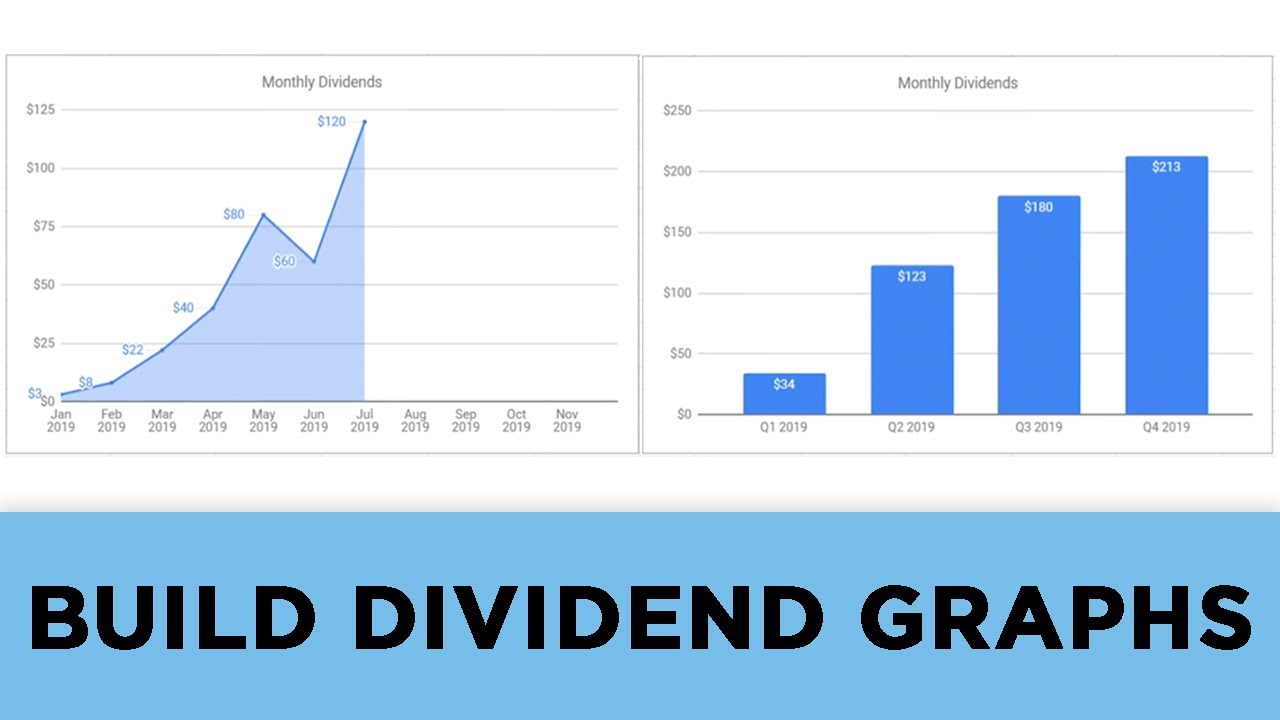

Tracking dividend payments over time

Tracking dividend payments over time

My Top 6 Dividend APIs

After extensive research, I’ve narrowed down my list to the top 6 dividend APIs that I believe offer the most value to investors. Here they are, in no particular order:

1. API 1

API 1 is a powerhouse when it comes to dividend data. With a vast database of historical dividend payments, it’s a go-to resource for investors looking to analyze dividend trends. I’ve used API 1 to identify undervalued dividend stocks and to track changes in dividend yields over time.

Analyzing dividend yields with API 1

Analyzing dividend yields with API 1

2. API 2

API 2 takes a different approach to dividend data, focusing on real-time dividend announcements and declarations. This API is perfect for investors who need to stay on top of market-moving news and announcements. I’ve used API 2 to set up custom alerts for dividend declarations, ensuring I never miss an opportunity.

Staying ahead of the curve with API 2

Staying ahead of the curve with API 2

3. API 3

API 3 is a relative newcomer to the dividend API scene, but it’s quickly become a favorite of mine. Its user-friendly interface and robust data analytics make it easy to identify dividend trends and patterns. I’ve used API 3 to identify dividend stocks with high growth potential and to track changes in dividend payout ratios.

Uncovering hidden gems with API 3

Uncovering hidden gems with API 3

4. API 4

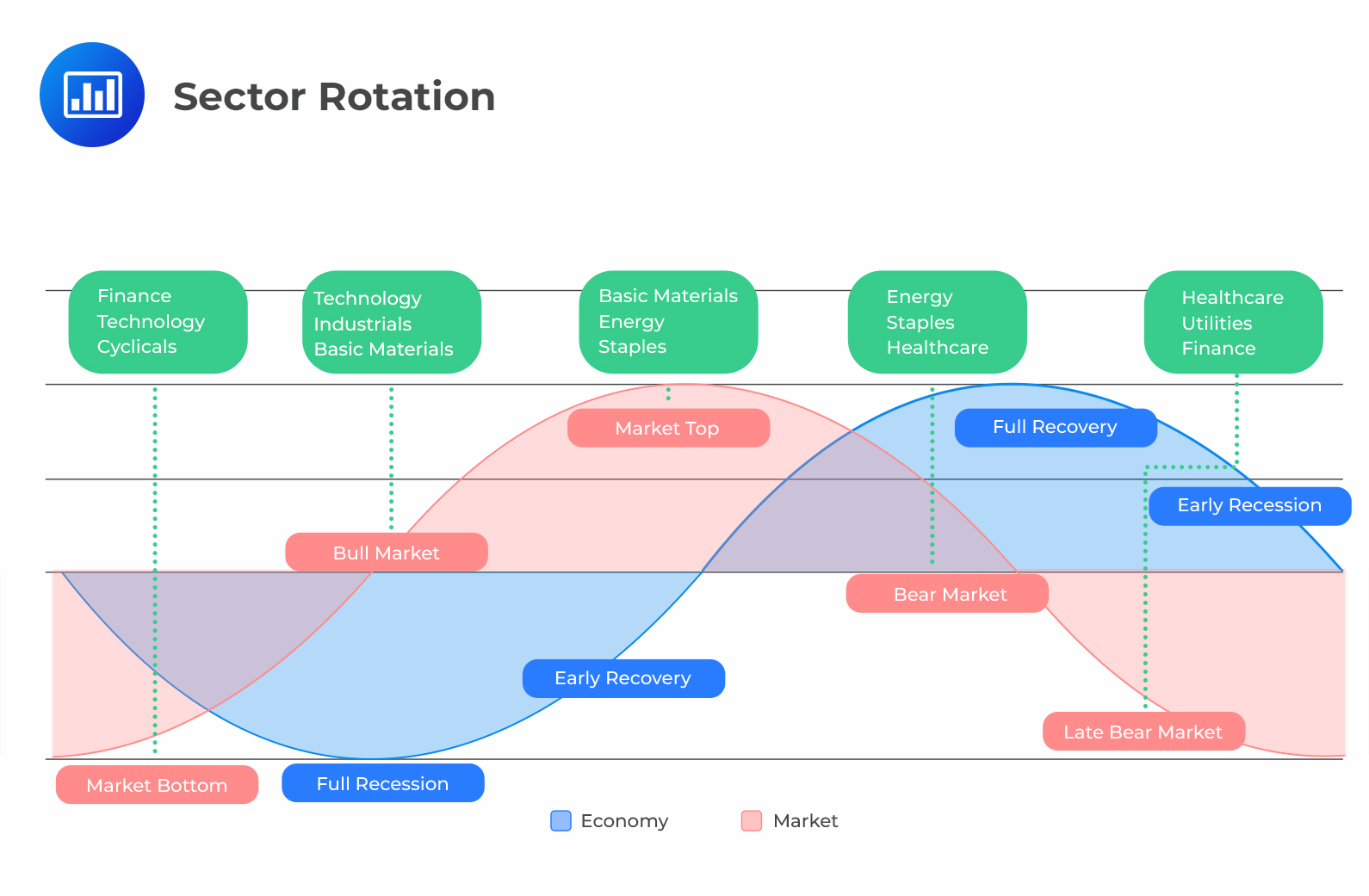

API 4 is a dividend API that’s specifically designed for institutional investors. With its advanced data analytics and customizable dashboards, it’s a powerful tool for portfolio managers and analysts. I’ve used API 4 to analyze dividend yields across entire sectors and to identify undervalued dividend stocks.

Drilling down into sector data with API 4

Drilling down into sector data with API 4

5. API 5

API 5 is a dividend API that’s focused on providing real-time dividend data and news. Its API is highly customizable, making it easy to integrate into existing workflows and applications. I’ve used API 5 to set up custom dividend dashboards and to track dividend announcements in real-time.

Building custom dividend dashboards with API 5

Building custom dividend dashboards with API 5

6. API 6

API 6 is a dividend API that’s designed for individual investors. With its user-friendly interface and affordable pricing, it’s an excellent choice for those just starting out with dividend investing. I’ve used API 6 to track my own dividend portfolio and to identify new investment opportunities.

Tracking my dividend portfolio with API 6

Tracking my dividend portfolio with API 6

Conclusion

In conclusion, these six dividend APIs have revolutionized the way I approach dividend investing. With their robust data analytics, real-time dividend announcements, and customizable interfaces, they’ve become an essential part of my investment toolkit. Whether you’re a seasoned investor or just starting out, I highly recommend giving these APIs a try.

The power of dividend investing

The power of dividend investing